Ethereum is the second most popular cryptocurrency in the world. It also ranks second in terms of market capitalization.

Ethereum’s popularity and price keep on growing, making it one of the most influential players on the crypto market. We will examine Ethereum platform in depth, explain what Ethereum is, who created it, and its impact on the community.

What Is Ethereum?

Ethereum is a decentralized platform that enables anyone to build and implement decentralized applications (dApps). The platform is also open-source, which means anyone can examine its code, updates, and other details in the GitHub repository. Ethereum is a public chain so that anyone who wants to become an ETH miner can freely join the network. All the transactions made on the blockchain can be easily found in the Ethereum block explorer.

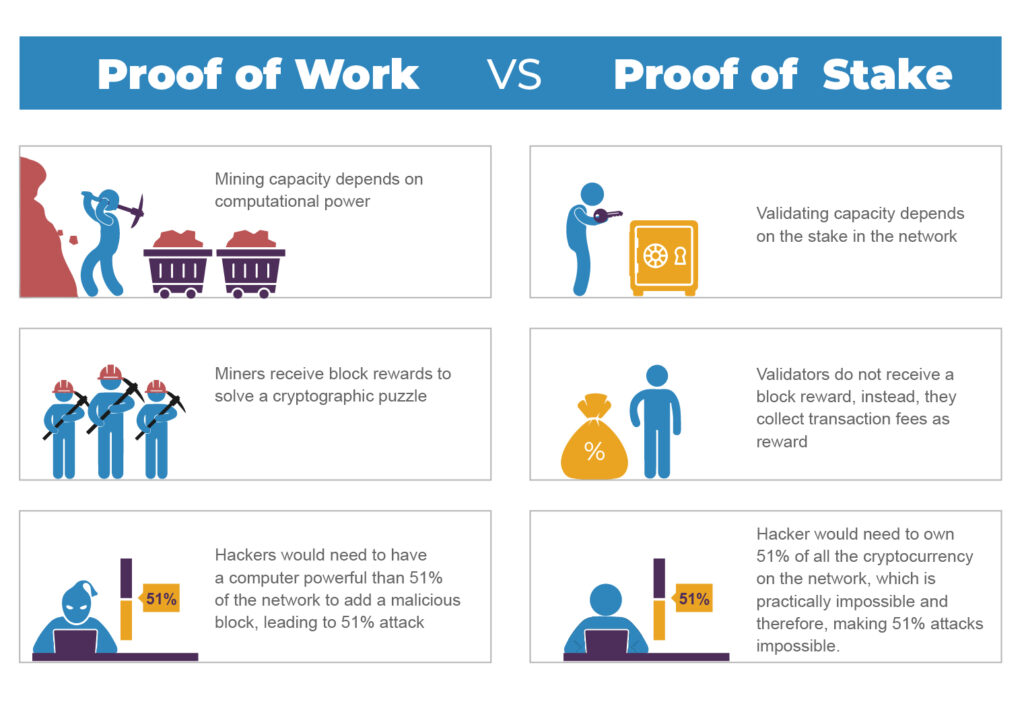

Initially, Ethereum blockchain utilizes the Proof-of-Work consensus algorithm that requires mining work. Just like the Bitcoin network, Ethereum has miners that sustain a healthy environment within the network, process transactions, and discover new blocks. In return, miners get a reward in ETH cryptocurrency.

However, at the end of 2018, the creator of Ethereum platform, Vitalik Buterin, introduced the concept of Ethereum 2.0. This updated decentralized platform would show better transaction throughput, be more scalable and efficient in use. Buterin wanted Ethereum to migrate from the PoW algorithm to PoS (Proof-of-Stake) for all the features mentioned earlier to come live. Ethereum 2.0 has a detailed roadmap as the migration of such a great network as Ethereum platform to the new algorithm will take much time and effort.

As of December 2020, all the conditions to bring Ethereum 2.0/Phase 0 are met. Buterin announced that the launch was successful. Leading exchanges like Binance and Coinbase will soon add ETH2 tokens to their platforms.

Let’s get back to Ethereum V1. What makes Ethereum so special?

Ethereum is unique because it is one of the first platforms that allow building and deploying decentralized applications. These applications do not assume any intermediary, and it brings people together directly.

According to the Ethereum white paper, there are three types of dApps:

- Applications that manage money. A user swaps Ethereum as a method of settling a contract with another user, using distributed computer network nodes to simplify the data distribution.

- Applications that run with money involved. It contains funds with the information outside the blockchain.

- Other applications, including governmental systems such as voting.

You can create your tokens based on the Ethereum platform. These tokens are called ERC-20. ERC (Ethereum Request for Comments) is the official Protocol for making proposals to improve the Ethereum network. Twenty (20) is the unique identification number of the proposal. Technical specifications for tokens issued on the Ethereum’s blockchain were published in 2015. Tokens that meet these specifications are known as ERC-20 tokens. They are smart contracts on the Ethereum blockchain. The real use-cases of Ethereum dApps will be described below.

What Is Ether?

Ether (ETH) is a native cryptocurrency of the Ethereum blockchain. Being an essential part of the entire network, ether plays several critical roles.

- ETH is used as a payment entity

- Ether fuels the whole network. Ethereum miners get paid in ETH so that transaction can be processed, blocks are added to the blockchain, and the network to operate flawlessly;

By the way, ETH and over 170 crypto-assets can be transferred to your wallet within several minutes. Changelly provides quick access to the world of crypto so that even your grandma can purchase cryptocurrency with a credit card, bank transfer, or Apple Pay.

Who Сreated Ethereum Platform

Anyone who is involved in the crypto industry probably knows two important names: Satoshi Nakamoto (the creator of Bitcoin) and Vitalik Buterin (the co-founder of the Ethereum platform). In 2013, a young programmer and a co-founder of Bitcoin Magazine Vitalik Buterin introduced a white paper where he described a decentralized platform that would allow building blockchain-based applications, using a Solidity programming language. By the way, Ethereum Foundation still supports the development.

Being involved in the crypto community, Buterin sent Ethereum’s white paper to his friends in order to get a review upon it. Instead, around thirty people contacted him to discuss the concept and the potential of the technology. At the end of 2013, there were several notable investors involved in the Ethereum project, which later would be called “the initial five.” These were Anthony Di Iorio, Charles Hoskinson, Mihai Alisie, Amir Chetrit, and Vitalik Buterin. Three more important co-founders joined the Ethereum team at the beginning of 2014. And the story of the most influential decentralized platform began.

Is Ethereum like Bitcoin?

Basically, bitcoin is the “father” to the rest of cryptocurrencies. Some projects just take Bitcoin source code in order to create their own blockchain-based cryptocurrency; some may upgrade the code and create another blockchain and cryptocurrency (like Bitcoin Cash, Litecoin, etc.) But all the crypto enthusiasts are inspired by Bitcoin technology. Vitalik Buterin has proved the fact that blockchain and cryptocurrency can be improved and be more than Bitcoin.

Generally speaking, ETH is like BTC – both of them are cryptocurrencies based on blockchain technology. However, the similarities stop here. Bitcoin is a digital currency with a limited issue. There are 21,000,000 BTC in the Bitcoin system, while Ethereum coins can be issued endlessly – ETH maximum supply is unlimited.

Ethereum offers multiple ways of technology usage. Due to smart contracts, Ethereum is a giant platform that provides developers with the necessary tools for building decentralized applications.

How Does Ethereum Work: Ethereum Blockchain

The Ethereum team created a virtual environment called Ethereum Virtual Machine (EVM), which allows smart contracts to interact with each other. Within the Ethereum network, nodes start the Ethereum blockchain, and this way, they form EVM. This system is better to be considered as a virtual computer on the Ethereum’s blockchain technology, which turns your ideas into code and reproduces it in the global network of Ethereum.

The ERC-20 standard is set for all tokens. It contains a set of rules for creating coins based on

Ethereum. Their observance is necessary for the regular interaction of tokens with the system. Access to blockchain resources is not free.

A transaction fee is paid for each operation. It is measured in units of gas. For all computational operations, it has its own fixed rate depending on the complexity. But you need to pay for gas in Ethereum, and the user sets the cost of each unit of fuel. The higher the execution price of a smart contract, the higher its priority and processing speed.

The Ethereum ecosystem consists of several essential components:

Accounts

There are two types in the Ethereum network: 1) externally-owned account (users’ accounts or those accounts that require private keys; 2) contract account or a smart contract. Such an account is controlled by the code.

Proof-of-Work (PoW)

Just like Bitcoin, Ethereum platform utilizes the PoW consensus algorithm. Yet, Ethereum requires less computational power. PoW allows miners to reach consensus and add new blocks to the chain. However, Ethereum developers are switching the mining algorithm to Proof-of-Stake.

Mining

Current Ethereum 1 requires mining and miners. The latter plays a crucial role in blockchain technology. In fact, miners validate transactions and add new blocks to the blockchain. Miners get rewarded with Ether. Please note that once Ethereum fully migrates to PoS, there will be no miners in the system. The network will be maintained by validators or stakers. Ethereum miners usually use CPU or GPU to mine ETH.

Blocks

Ethereum miners compete with each other in order to find the right hash of the next block. Once it is found, the next block is added to the chain while a miner gets a reward. Each block consists of several components, including header, nonce, the hash of the previous block, information about comprised transactions, and so on.

Gas and fees

Users usually complain about high fees within the Ethereum system. Each computation performed on Ethereum platform is actually a transaction that requires users to pay a fee. Ethereum transaction fees are denominated in gas. When initiating a transaction, a user sets the gas limit and gas price – the amount of gwei (a unit that a sender wants to pay for the transaction execution). The higher is the gas price, the faster miners will process the transaction.

Proof-of-Stake (PoS)

Ethereum’s 2.0 Phase 0. Serenity introduces Ethereum Beacon Chain which will help the network to migrate from PoW to PoS. The idea was implemented at the beginning of December enabling staking. The next year is promised to be exciting for the Ethereum community.

Ethereum blockchain is impossible to hack. However, there was a situation that led to a conflict within the community and later to a hard fork.

The scandal around Ethereum occurred in the middle of June 2016. Anonymous bad actors could withdraw over $60 million from the Decentralized Autonomous Organization (DAO). In order to fix the situation, there were three options proposed:

- Implement a soft fork and rollback the system

- Make hard fork and reset smart contracts, which the attacker implemented

- To not interfere in the process

On July 20, developers, together with the community, chose the second option, and the great Ethereum split occurred. The hard fork helped to return stolen funds to victims, while two separate chains came into life – Ethereum (ETH) and Ethereum Classic (ETC)

Some Ethereum developers focused on the new chain (Ethereum), including Vitalik Buterin, Charles Hoskinson, and Gavin Wood. Some were against such radical changes as they followed the rule that “code is the law.” These developers and community members stayed on the old (and the original chain) named Ethereum Classic (ETC).

Today, ETC and Ether do not differ that much. Both blockchains keep moving forward by introducing new features and updates.

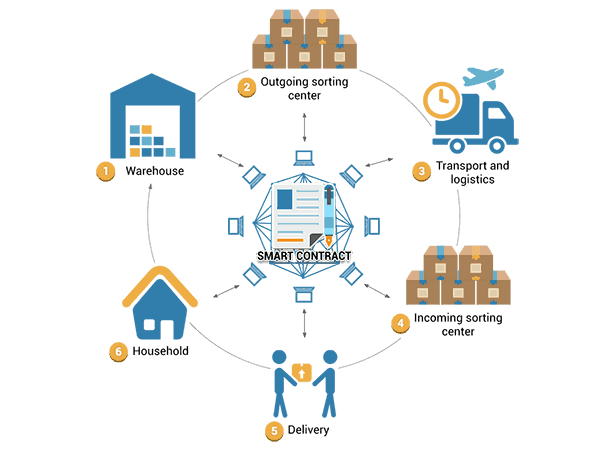

Ethereum Smart Contracts

Ethereum was one of the first platforms to offer smart contracts. Back to glorious for Initial Coin Offerings (ICOs) year 2017, Ethereum network became extremely popular as most of “top-notch” projects introduced Ethereum-based platforms and issued ERC-20 tokens.

What does Ethereum blockchain allow users to do?

- Build complex smart contracts for supply chain management;

- Run various applications, from utilities to games;

- Turn into tokens any assets, including various cryptocurrencies, fiat, and even precious metals;

- Create user identification services, document authentication, etc.

- Organize a decentralized asset exchange.

Gaming and gambling dApps boosted the awareness of the crypto industry while bringing a new look to the entertainment sector as well. A well-known gaming application built on the Ethereum blockchain, CryptoKitties, managed to slow down the whole network because of its great popularity and desire of users to have an “immortal pet.”

This year, the decentralized finance sector has definitely impacted both Ethereum’s recognition outside the crypto industry and ETH price. Most decentralized exchanges (DEXs) are built on the Ethereum blockchain, the leading stablecoins and DeFi tokens are Ethereum-backed. DApps that are built with the help of Ether take more than 50% of all blockchain-based applications.

Pros and Cons of Ethereum

No one is perfect, and just like the rest of the things in the world, Ethereum has its ups and downs. In order to inspect the network from different perspectives, we have gathered Ethereum’s ups and downs.

Pros of Ethereum

Ethereum is the first platform to offer developers a friendly environment and ecosystem for decentralized application deployment. There are toolkits, tutorial videos, and articles that provide comprehensive instruction on how to build dApps on the Ethereum blockchain. Plus, ethereum.org supports over 30 languages, making access to the platform available for many countries and nationalities.

Ethereum being decentralized gives users so-long awaited freedom and a chance to spread the power among all network participants. There is no central authority that can edit or influence the network in any manner. It is theoretically impossible to hack Ethereum (or any other blockchain technology). Therefore, the Ethereum network is a secure and safe spot for making your crypto ideas a reality.

Cons of Ethereum

Ethereum 1 faces the same challenges as the rest of PoW-based blockchains that require many resources for mining (both electricity expenses and equipment). Being utilized PoW algorithm, Ether makes its users pay gas fees that, in time of network’s overload, can be very high.

Besides, the current Ethereum network is capable of processing around 15 transactions per second (TPS), which is definitely not that much. However, once all the preparation work is done, and Ethereum will be fully switched to Ethereum 2.0, all the current disadvantages of the network will be eliminated.

How to Get Ether

Primarily, there are two ways to get ETH: you can either mine it or buy it on a cryptocurrency exchange.

If you decide to mine ether, then you have to be prepared accordingly. ETH digital currency’s miner should obtain proper mining equipment, have a secure digital wallet to store ether, join a trustable mining pool (in case he/she does not want to mine the cryptocurrency solo).

The hash algorithm used by Ethereum is called Ethash. It hashes the metadata of the last block in the system using a unique code called a nonce (a random binary number that sets the exceptional value of the hash function). For each new block in the blockchain, the network sets a target hash value, and all miners in the system try to guess the nonce value that will lead to such a value.

The underlying cryptographic principles make a random selection of nonce almost impossible. This means that the only way to find the correct nonce is to cycle through the entire range of possible solutions until the correct one is found. In this case, the solution can serve as “proof of work” that the computer detected the correct nonce value and completed the work. In other words, they are using computing power to run the hashing algorithm.

Is it profitable to mine ETH? To answer this question, you need to take into account many factors:

- Power cost

- Hardware cost

- Pool fees

- ETH/USD exchange rate

- Hash rate

You can always check your profit using the mining calculator.

In order to get all the nuances of ETH mining, we’ve collected articles that help you start mining this digital currency.

Best Ethereum (ETH) Mining Rig Specs: Hardware & Software

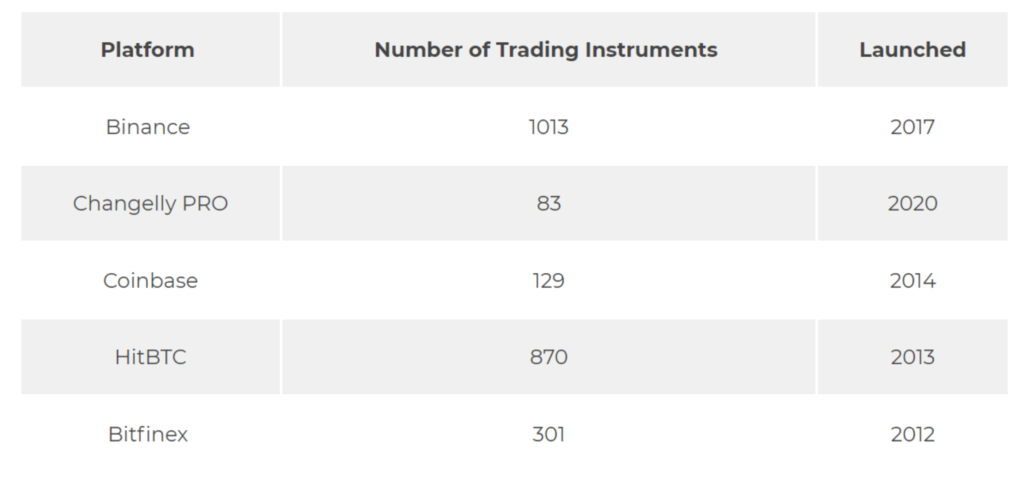

Since Ethereum is the second-largest cryptocurrency by market cap, it can be purchased on pretty much every crypto exchange and via multiple payment methods. We are going to provide a list of the best places to trade and buy ETH in the following paragraph.

Where to Buy and Sell Ether

If you want to buy ETH swiftly using your Visa/Mastercard, bank transfer, or Apple Pay, then Changelly will be your last stop. Buy ETH instantly or swap it to 170+ altcoins within minutes. There is a wide range of fiat currencies available – just pick the one that suits you the most. Changelly partners with the best fiat-to-crypto providers that help us offer you the most competitive rates on the market.

In order to choose the best place for cryptocurrency trading, one should remember the golden rule of the industry – whenever you do, do not forget to do your own research (DYOR). It is vital to come up with features that are essential to you personally. However, there are some points that should be taken into consideration no matter what cryptocurrency trading spot you choose.

- To eliminate problems with deposits and withdrawals, don’t forget to check whether the exchange is available in your country of residence. This can be discovered in the Privacy Policy section that every decent exchange must have;

- One should examine closely all the aspects of commissions charged on a particular exchange;

- Check the number of markets available on an exchange. It is also important to know whether the exchange allows for fiat deposits or not;

- The security of the trading platform is actually the security of your funds. Don’t forget to check what precautions an exchange takes in order to keep your deposits safe and sound. It is also highly recommended to set a 2-factor authentication. In case anyone decided to put hands in your jar, you would get an alert right away;

- Learn about an exchange: its history, reputation, reviews (especially the bad ones). However, remember that users do not like to leave positive reviews but often focus on negative ones. Read them critically.

- Even if you are an experienced trader, you will contact the exchange’s support sooner or later. In this case, it is crucial to know whether support is responsive and helpful;

If you prefer to trade ETH with ease while expressing the nativity and security of a trading platform, here is a list of the top five robust trading platforms that might help you to do so.

Future of Ethereum

The future of the second cryptocurrency seems to be bright and promising. Upcoming improvements are going to upgrade not only Ethereum but also the whole blockchain industry: the decentralized finance (DeFi) sector, the gaming industry, blockchain development sector, and many others. Needless to say, all these upgrades require time and human resources, but it seems that Ethereum is doing great. And just like with smart contracts, Ethereum is going to revolutionize the crypto industry once again.

Via this site